EOFY (End of Financial Year) isn’t just for financial planning, it’s the ideal time to assess your workplace safety strategy. This EOFY safety checklist outlines how smart safety investments can help you reduce risk, meet compliance obligations, and claim valuable tax deductions.

EOFY isn’t just about number-crunching though; it’s an opportunity to invest strategically in the long-term success of your business. While upgrading equipment or marketing might be at the top of your mind, don’t overlook the power of investing in workplace safety. Let’s be honest, keeping up with ever-changing OHS regulations, creating clear safety procedures, and finding the time to train your team properly can feel overwhelming. The consequences of getting it wrong are serious - costly incidents, legal trouble, and damage to your reputation.

As tax time approaches, businesses should consider their safety investments in light of potential tax deductions. This period is an opportune time to assess work-related and income-generating expenses for tax benefits. But what if there was a way to simplify safety, ensuring you protect your workers and your business while potentially maximising your EOFY tax deductions? That’s where pre-made OHS resources tailored to your industry come in.

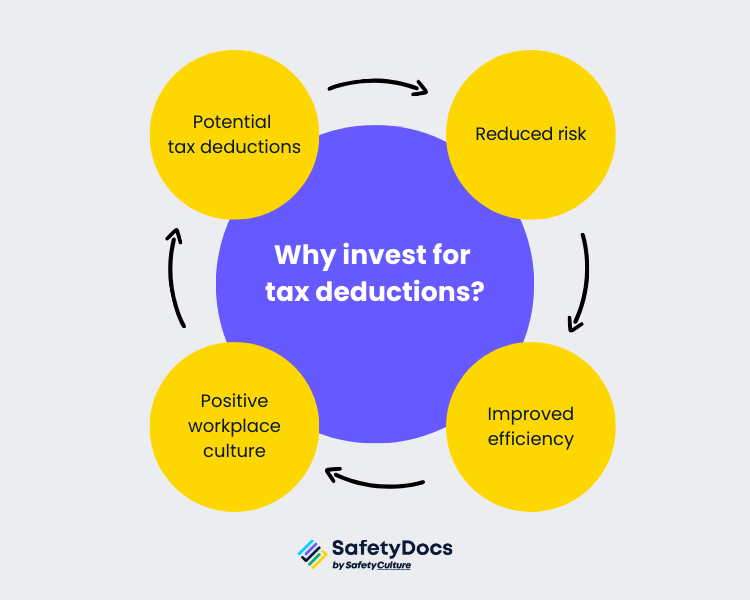

EOFY Safety Success: Why Invest for Tax Deductions?

Workplace safety shouldn’t be viewed as just a box to tick. A well-managed OHS system contributes to your bottom line in several ways:

- Reduced Risk: Fewer accidents mean lower insurance premiums, less downtime, and protection against costly fines.

- Improved Efficiency: Clear safety procedures streamline operations, reducing errors and minimising time lost to incidents.

- Positive Workplace Culture: When employees feel safe and valued, morale and retention improve, ultimately saving you money on recruitment and training in the long run.

- Potential Tax Deductions: Safety investments, like OHS documents and training, may be tax-deductible. For specific advice on maximising these deductions, it's wise to consult a tax professional or registered tax agent. EOFY is the perfect time to make these upgrades and potentially gain those valuable tax benefits.

Case Study Spotlight: Building Safety from the Ground Up

Note: This example is fictional and designed to illustrate the benefits of strategic early investments in safety and quality systems for a small, newly established manufacturing company.

Background:

FutureFab Manufacturing is a new manufacturing business with five employees, initially operating with minimal safety and quality systems. Recognising the need for structured frameworks, the company decided to invest early in compliance.

Challenge:

As a fledgling operation, FutureFab Manufacturing faced the dual challenges of establishing a safe work environment and ensuring product quality to build market credibility and meet regulatory standards, all within the constraints of a startup budget.

Action Taken:

To address these challenges, the company invested in a plant safety management plan and a quality management system designed specifically for small manufacturing operations. These investments included:

- Plant Safety Management Plan: This plan provided detailed guidelines for machine safety, hazardous material handling, and emergency response procedures tailored to their specific operational needs.

- Quality Management System (QMS): The QMS helped in setting up processes that ensure product quality and consistency, which are critical for gaining customer trust and complying with industry standards.

Strategic safety investments enhance operational efficiency and can positively impact business income by reducing taxable income through tax deductions.

Outcomes:

- Enhanced Safety Compliance and Reduced Risk: The plant safety management plan immediately improved workplace safety, significantly reducing the risk of accidents and associated costs.

- Established Quality Assurance: The QMS enabled the company to maintain high-quality production standards from the start, reducing waste and rework, and optimising operational costs.

- Improved Employee Morale and Retention: Implementing structured systems for safety and quality from the beginning fostered a positive workplace culture, enhancing employee satisfaction and retention.

- Financial and Operational Benefits: The company leveraged EOFY tax deductions for initial safety and quality systems investments, alleviating some financial pressures and supporting further investments in business growth.

Conclusion:

FutureFab Manufacturing's proactive approach to integrating a plant safety management plan and a quality management system at the early stages of business operations shows how crucial these elements are for compliance and establishing a strong operational foundation. These strategic investments helped the company safeguard its employees, ensure product quality, and position itself for sustainable success and growth in a competitive market.

EOFY Safety Checklist: Make Smart Workplace Safety Decisions

Unsure where to start with your EOFY safety upgrades? Follow this checklist to pinpoint your business’s needs. Before diving into the specifics, businesses should review their expenses to identify opportunities to claim tax deductions for safety-related investments, ensuring they maximise their financial benefits while enhancing workplace safety.

Before June 30, review your workplace safety procedures and documentation to ensure they’re up to date and deductible.

Step 1: Assess Your Current OHS System

Begin your EOFY safety checklist by asking:

- Are your SWMS, SOPs, and incident reporting procedures up-to-date and aligned with the latest regulations for your industry?

- Does your team receive regular safety training, and is it well-documented?

- Are your safety-related invoices and receipts well-organised for potential tax deductions?

Be honest. This isn’t about passing an audit with minimal effort but genuinely identifying where your safety systems could be stronger. Consider evaluating your safety systems for work-related expenses that could be eligible for tax deductions.

Step 2: Identify Gaps and Areas for Improvement

- Risk Focus: Where are the most hazardous tasks in your operations? Are there processes where errors frequently happen, increasing the chance of incidents?

- Efficiency Matters: Are there areas where a lack of clear safety procedures leads to confusion, wasted time, or bottlenecks in your work processes?

- Training Needs: Do new employees receive adequate safety instruction? Does your team need refreshers on existing procedures?

- Safety Equipment Assessment: Have you evaluated your need for personal protective equipment and protective clothing? This step is crucial for protecting staff from safety hazards and ensuring compliance with regulations on work-related expenses.

Identifying gaps now gives you time to implement changes before EOFY, making your expenses potentially tax-deductible.

Step 3: Explore the Benefits of Pre-Made OHS Resources

- Time Savings: Creating effective SWMS, SOPs, and training materials from scratch is a major time commitment. Pre-made, industry-specific resources give you that time back to focus on running your business.

- Expertise Built-In: Professionally developed OHS documents ensure you’re not just meeting standards but exceeding them and implementing real-world best practices.

- Cost-Effective: Compare the cost of curated Industry Packages against what you might spend on a consultant to develop custom materials. Often, the pre-made option is significantly more affordable. Investing in pre-made OHS resources can be an effective strategy for managing most business expenses, especially when preparing for EOFY tax deductions by claiming deductions on operating costs, interest, and other business-related expenses.

Investing in compliant, pre-made OHS documents before EOFY can streamline your safety management and support tax deduction claims.

Step 4: Evaluate Your Management System

Do you have a comprehensive approach to OHS that goes beyond individual procedures? A strong management system ensures that all the pieces work together effectively.

If your management system needs improvement, consider an Industry Suite package. These provide complete systems specifically designed for your industry sector.

EOFY Industry Insights: Safety and Tax Deductions by Sector

We understand there is a lot to consider in building your OHS practices, which varies by industry. We’ve highlighted a few below and outlined key areas for addressing with appropriate safety documents and systems.

Construction

- Common Hazards: Falls from height, electrocution, machinery hazards, trench collapses, and working with hazardous materials.

- Benefits of Industry Packages: SWMS templates for common construction tasks, SOPs on key safety protocols, and guidance on integrating these into an effective construction safety management system.

- SWMS and SOPs purchased before EOFY may be eligible as deductible business expenses.

Manufacturing

- Focus on Machinery Safety: Manufacturing facilities are full of potential hazards, with machinery posing a significant risk. The importance of occupation-specific clothing in this context cannot be overstated, both for safety and for potential tax deduction purposes, as it includes uniforms and attire that directly relate to the job.

- Industry Package Value: Our Manufacturing package provides SWMS templates for operating specific machinery, ensuring proper lockout/tagout procedures are followed. Included SOPs will outline safe work practices for machine operation, maintenance, and cleaning. Support for developing a tailored machinery safety management system for your facility.

- Include occupation-specific protective clothing in your EOFY tax planning, especially where industry compliance requires specialised uniforms.

Warehousing & Transport

- Benefits of Industry Packages: Includes SWMS templates for manual handling tasks, emphasising safe lifting techniques. SOPs guiding the safe operation of forklifts and other powered mobile equipment. Frameworks to manage your overall manual handling and vehicle safety risks. It's also crucial to protect ordinary clothes with industry-specific safety gear, such as aprons, overalls, and smocks, which may qualify for tax deductions.

EOFY Tax Q&A: Claiming Safety-Related Expenses

EOFY is your window to claim eligible business safety expenses - use this FAQ to guide your claims preparation.

While every business situation is unique, understanding the potential tax benefits of safety investments can help you make informed EOFY decisions. Here are some common questions to keep in mind – but always consult your tax advisor for advice tailored to your business.

Q1: Are OHS documents and resources tax-deductible?

A: Generally, expenses incurred to protect the safety of your employees and comply with OHS regulations may be considered business expenses and thus potentially tax-deductible. This can include the cost of purchasing pre-made documents, safety equipment, and safety training programs. Consulting the Australian Taxation Office is advisable for specific guidelines on what qualifies as a 'tax deduction'.

Q2: Are there specific types of safety expenses that are more likely to be deductible?

A: Safety investments directly related to preventing workplace injuries and illnesses are generally viewed favourably for deduction purposes. These include things like fall protection equipment, first aid kits, and signage outlining safety procedures.

Q3: Does the timing of the purchase matter for deductions?

A: In some cases, the timing of your purchase can impact when you can claim the deduction on your tax return. It’s worth exploring whether your business could benefit from making OHS purchases before the end of the financial year to ensure timely submission and potential deductions.

Q4: Can I claim a deduction for safety-related improvements to my workplace?

A: Potentially, yes. Costs associated with modifications to your work environment to improve safety may be eligible for deductions. These could include installing guardrails, non-slip flooring, or ergonomic workstations.

Q5: What records do I need to keep to support my safety expense deductions?

A: It’s essential to maintain detailed records of all your safety-related purchases and expenses, including those for non-compulsory work uniforms, as tax deductions may not be straightforward. This includes invoices, receipts, training certificates, and any other documentation demonstrating the expenditure’s nature and purpose.

Q6: I’ve invested in new safety equipment. Can I claim the full cost as a deduction, or does depreciation apply?

A: The deductibility of safety equipment often depends on its cost and expected lifespan. Lower-cost items may be fully deductible in the year of purchase, while more expensive equipment may need to be depreciated over several years. It’s essential to consult with your accountant to determine the best approach for your specific assets and business scenario.

Important Disclaimer: The information provided here is for general guidance only and does not constitute professional tax advice. Regulations can change, and individual circumstances vary. Always consult with a qualified accountant or tax advisor to discuss the deductibility of your safety-related expenses.

Take the Next Step: Simplify Safety and Manage Business Expenses

Investing in a robust OHS system isn't just about compliance. It safeguards your employees, improves operational efficiency, and positively impacts your bottom line. Let this EOFY be a turning point for safety in your business.

Don't miss the chance to simplify your safety upgrades AND potentially maximise your tax deductions.

SafetyDocs By SafetyCulture Industry Packages eliminates the headache of creating WHS documents from scratch. Browse our pre-made WHS Industry Packages to simplify your EOFY safety checklist. With expert-developed documentation and built-in compliance tools, you’ll be ready to protect your team and support your EOFY tax deductions.

Author - Craig Cruickshank is the HSEQ Manager and Senior Technical Advisor at SafetyDocs by SafetyCulture.

Craig comes from a construction and environmental background, with experience in both the private and public sectors and is passionate about making health and safety information easy to find and understand for everyone.

Learn more about Craig's work on LinkedIn

Available for instant download and supplied in fully editable MS Word format for use in your business.

Please note that the above information is provided as a comment only and should not be relied on as professional, legal or financial advice.

Share This Article